Belts may be tighter in 2010

There are many reasons to be optimistic about the economic future of Australia. Our regional positioning increases demand for our rich supply of resources; our stable banking system and relatively low government debt frees the economy from many of the constraints facing other developed economies; and there are increasing signs that the construction industry may provide a new stimulus to economic growth as the shortage of both housing and infrastructure facilities is rectified over the next few years.

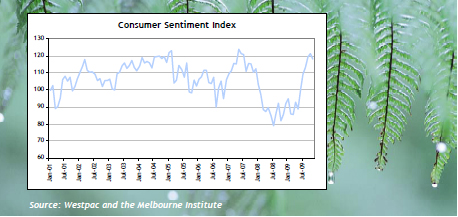

Consumer confidence is rising

As we enter 2010, surveys of consumer sentiment indicate that Australians are feeling confident and, no doubt, relieved that the global financial crisis (GFC) has not affected the real economy as much as was feared this time last year. According to the November Westpac Melbourne Institute Index of Consumer Sentiment, the level of confidence Australians have about their future financial prospects is 18% above the longer-term average. This follows a remarkable recovery in confidence over the course of 2009.

Normally, a high level of consumer confidence is followed by a period of high growth in consumer spending. However, despite this recent surge in confidence, Australian households could do it quite tough in 2010.

Rising interest rates, additional increases in unemployment and the reduction in paid working hours in 2009 will constrain household budgets in 2010. In addition, the benefits of our rising Australian dollar on the affordability of imported goods may not be repeated next year.

How has the GFC influenced the future?

With the GFC came a realisation around the globe that households could not continue to increase their spending on consumption goods at the same rate as in the past. Accumulated debt needed to be repaid via higher rates of savings. In addition to a general change in the attitude towards debt, banks will no longer be willing to make debt as freely available as they have in the past. Despite Australia coming through the financial crisis in better shape than other western economies, non-housing related lending to consumers has been tightened. In the year to September 2009, the level of credit card debt increased by just 2%. This is the lowest rate of growth in credit card debt for 17 years and compares to annual rates of growth of more than 30% earlier this decade.

The need for many households to adjust spending was temporarily delayed as a result of falling interest rates and the government stimulus payments. Although Australian households had started to increase their savings rate before the GFC, savings rates are only a fraction of what they have been in previous decades. In June 2009, the percentage of household disposable income saved in Australia was 4%. In the 1970s and 1980s this ratio averaged 13%.

The combined actions of the government’s fiscal policy, and the Reserve Bank’s monetary policy settings, means that for may Australians the real impact of the financial crisis has been shifted from 2009 to 2010 and beyond. However, some forced belt tightening by Australian consumers may not necessarily be a bad thing. It is part of the longer-term adjustment required in the economy; there is every prospect that exports and increased construction activity will make major contributions to growth over the next couple of years. Our current confidence in the economy may still well be justified.